Noble Street Model Portfolios

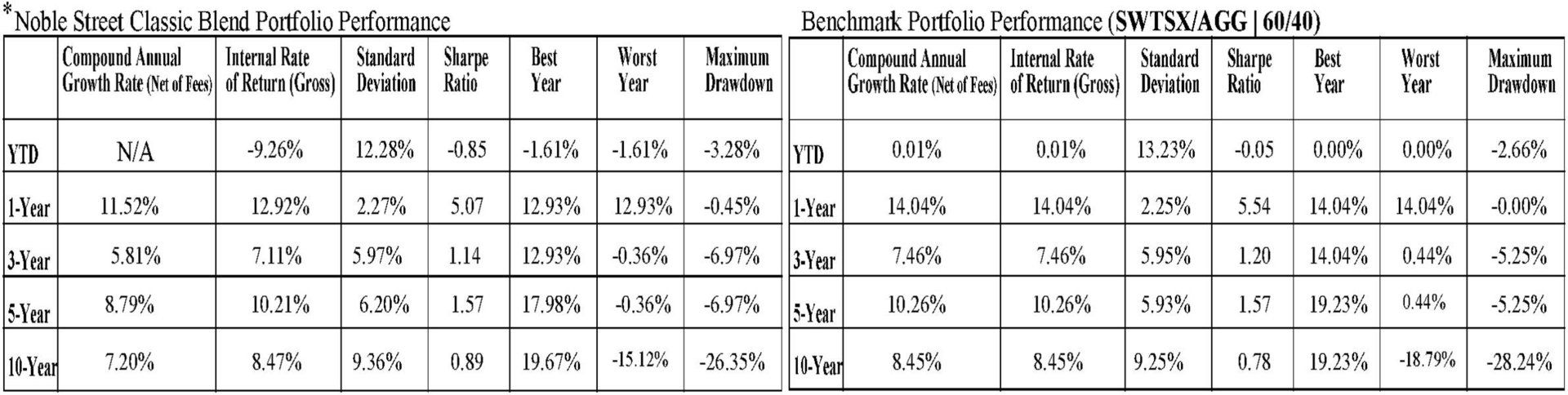

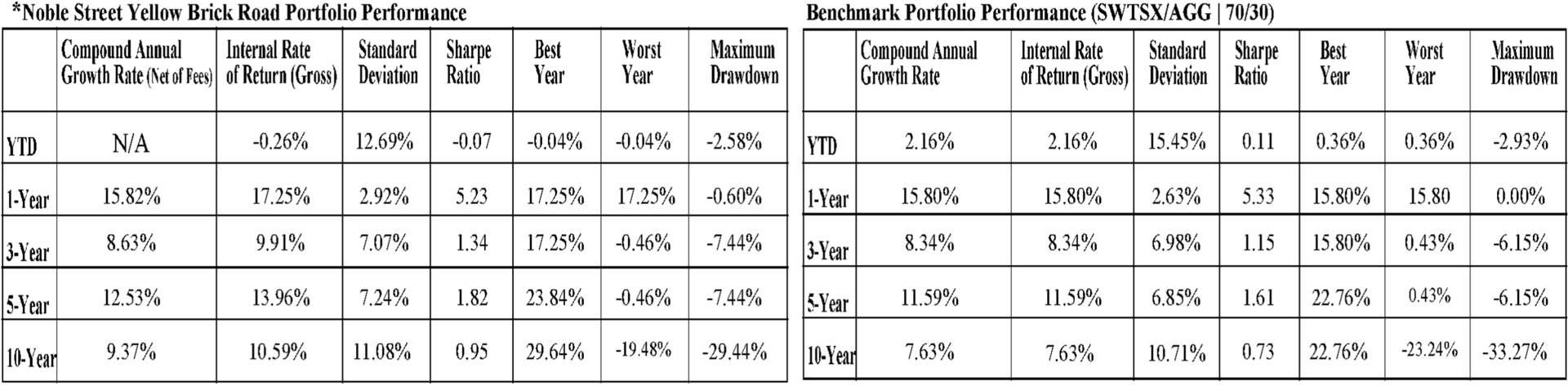

Noble Street Portfolio Models are strategically weighted and constructed based on long-term strategic asset allocation. Our portfolio models consist of low cost, no load, no transaction fee ETF's. My goal with every model is to outperform each portfolios benchmark while reducing downside volatility and drawdown risk.

Year To Date returns displayed for Noble Street Portfolios and their Benchmarks are from 01/01/2018 through 02/28/2018. Years 1, 3, 5, and 10 returns displayed are as of 12/31/2017. Performance results displayed for Noble Street Portfolios take into consideration management fees, the benchmarks do not. Noble Street Portfolios and their benchmarks assume reinvestment of dividends and capital gains with annual rebalancing. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the portfolio may be lower or higher than the performance quoted.

Noble Street Dynamic Growth Portfolio | 90/10

Noble Street Yellow Brick Road Portfolio | 70/30

Noble Street Classic Blend Portfolio | 60/40

Noble Street All Weather Portfolio | 40/60

Noble Street Guarded Growth Portfolio | 25/75

What Type of Investor Are You?

Income

An income-oriented investor seeks current income with minimal risk to principal, is comfortable with only modest long-term growth of principal, and has a short- to mid-range investment time horizon.

Balanced

A balanced-oriented investor seeks to reduce potential volatility by including income-generating investments in his or her portfolio and accepting moderate growth of principal, is willing to tolerate short-term price fluctuations, and has a mid- to long-range investment time horizon.

Growth

A growth-oriented investor seeks to maximize the long-term potential for growth of principal, is willing to tolerate potentially large short-term price fluctuations, and has a long-term investment time horizon. Generating current income is not a primary goal.

Still not sure? Don't worry, our risk assessment combined with helping you define your goals and objectives will uncover what allocation will work best for you.

Despite the diversified investment approach and our aim to deliver consistent positive returns, positive returns are not guaranteed and the portfolios are subject to the risk of loss of principal. All securities carry risk of loss that clients should be prepared to bear, including the risk that an investor may lose a part or all of his or her initial investment. Some of the general risks associated with parts of our investment strategy are; Market risk, Interest rate risk, Bond pricing, Inflation, Price fluctuation, Reinvestment of Dividends,

Mutual Funds with Foreign Asset Holdings and Alternative Asset Classes. While an attempt is made to minimize these risks through prudent investment strategies and portfolio design and construction, the risk of loss to the client is still present and real. Clients are encouraged to discuss their evolving risk tolerance with their Representative at any time.

Noble Street is the marketing name for Noble Street Wealth Management, LLC., a State Registered Investment Adviser, member FINRA. Fiduciary Fee-only Financial Planning and Consulting and Investment Management services are offered through Noble Street. Life and Disability Insurance, Annuities, Life Insurance with long-term care benefits, Long-Term Care Insurance and Employee Benefits are offered through Noble Street Financial, LLC., a licensed Life, Health and Accident Insurance Agency and affiliate of Noble Street.

In the course of assisting clients with constructing a comprehensive financial plan, Noble Street may recommend insurance products to a client, offered through Noble Street Financial, LLC. Clients are under no obligation to use Noble Street Financials' services and have the option to work with the insurance agent/agency of their choice. Products and services referenced are offered and sold only by appropriately appointed and licensed entities and financial professionals. Not all products and services are available in all states.

The use of the term "Registered Investment Adviser" and description of Noble Street and/or our associates as "registered" does not imply a certain level of skill or training.

Copyright © 2017 Noble Street Wealth Management, LLC. All Rights Reserved. | Privacy Policy | Noble Street Form ADV